How Do Owners Make Money From An Ipo

How to make money from an IPO?

![]()

Note: Most of the content of this article is only applicable for Malaysian stock market.

Before we delve into the IPO, let us look at some fundamentals of a company's structure.

A company consists of 3 core aspects: Shareholders, Board of Directors (BoD), and the Management. Shareholders, who are the main focus of our topic today, are people who invested into the company. To start a company, one must go to Suruhanjaya Syarikat Malaysia (SSM) to register a Sendirian Berhad or Berhad (i.e. private company), together with people who wanted to fork out some money and start the business together, a.k.a. your shareholders.

The company c ould, at one point of a time, consider to expand their business, which in turn requires more money. The management could utilise internal funds (accumulated from company profit, but terribly slow), apply for a bank loan, or ask shareholders to pour more cash into the company. You can also raise funds from an external source, such as someone you are familiar with, a private equity fund, or even crowdfunding.

We are going to focus on one method that most large companies would opt for: public listing.

What is an IPO?

What can a shareholder do if he or she wishes to let go of the shares in hand? This is particularly more troublesome in a private company due to the limited options available:

- Sell to another person he/she is familiar with;

- Sell to other shareholders of the company;

- Withdraw from the company (which requires consent from all shareholders)

What is a public listing? It means making company shares tradable in an open market (means stock market loh). This particular shareholder that we mentioned earlier would then be able to sell his or her share to the public easily. List the shares to sell, then wait for the public to buy from you. How easy could it be?

The company to be publicly listed would first issue new shares for subscription by the public. It is also a fundraising exercise from an external source, with the difference that you make it open for public.

IPO is the issuance of new shares to the public.

The true purpose of IPO

People may ask at this point, "doesn't that mean I'm sharing my company's profit to many outsiders that I might not even know them in person?". Technically, they are right.

Nevertheless, of all fundraising methods available, IPO is capable of raising the most amount of money within the shortest time possible. (by not taking into account of enormous private equity funds that are able to splash billions of dollars into a company, such as SoftBank)

Due to such nature, it's important to have a governing body, i.e. Securities Commission (SC) in Malaysia, to regulate the IPO process, thus minimising frauds. Companies must submit their IPO application to SC for listing approval, which is evaluated by a set a requirements that the said company must comply.

Why subscribe to IPO?

The IPO would be announced to mass media upon approval. The announcement includes a prospectus available for reading by the public. The prospectus is one of the most important documents in an IPO procedure, where it consists of key information such as:

- nature of business,

- members of the Board of Directors (BoD),

- reason of listing,

- how much money the company planned to raise,

- future plans for the next few years.

Investors would then make use of whatever information available in the prospectus to judge whether the IPO is worth to buy.

However, that is not the most important reason to subscribe to an IPO share.

In many cases, the issue price of the IPO share would be lower than the market value.

Think of it as a newly launched residential project, where Phase 2 is generally more expensive than Phase 1, Phase 3 more expensive than Phase 2, and so on; or a new product that you have pledged in Kickstarter is definitely cheaper than the retail price when it hits the stores.

IPOs are like early-bird promotions; you bought them at a lower price, thus greatly reducing your risk of loss.

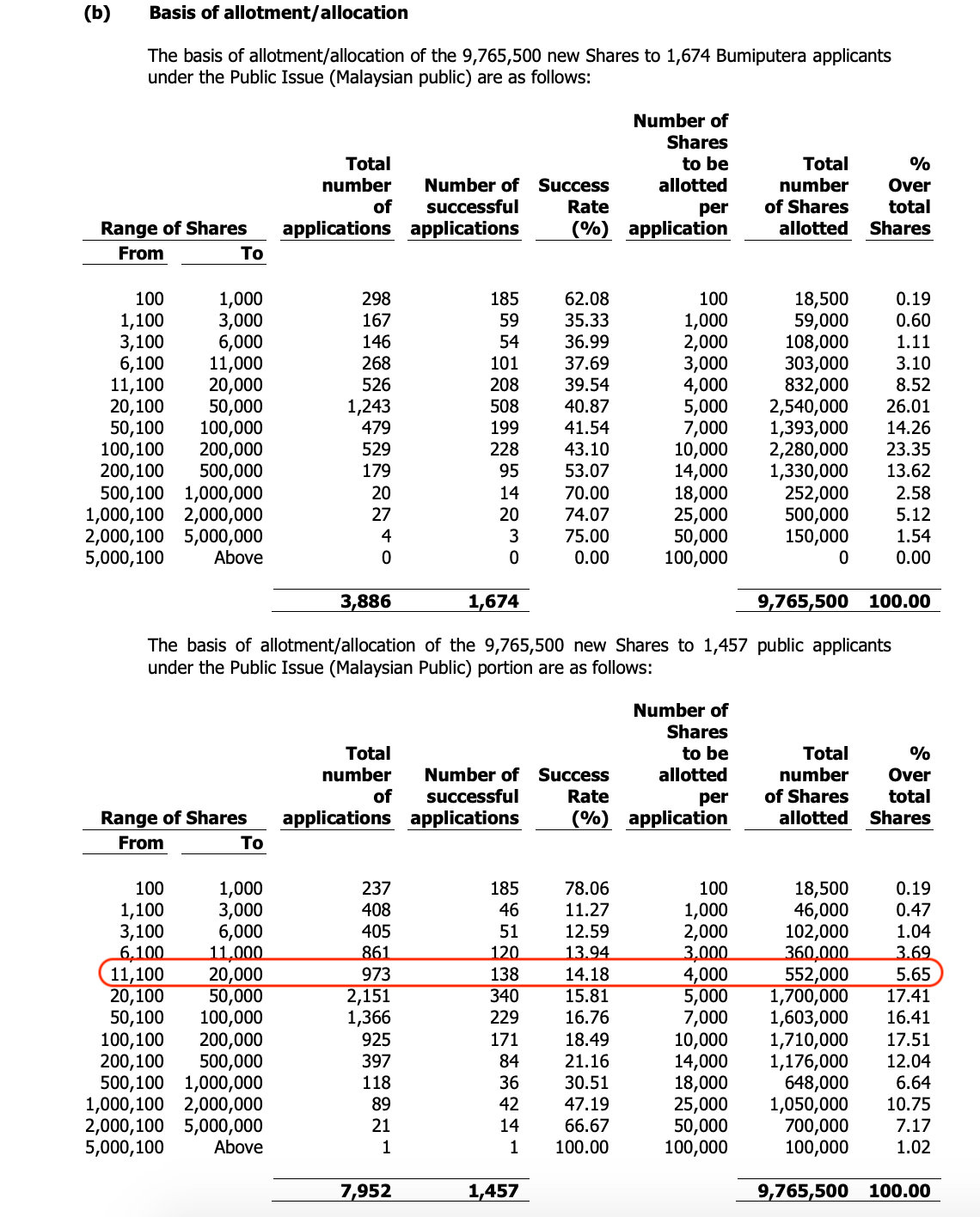

However, there are only limited slots available because the amount of money to raise cannot be changed. Furthermore, the application result is determined by balloting, not first-come-first-served. The terminology that we use here is called "over-subscribe", a situation where there were too many applicants. We are going to use Solarvest Holdings Berhad, an upcoming IPO, as an example.

Applications were divided into difference ranges that would be balloted respectively. Of 973 applications who applied for a range of 11,000–20,000 shares, only 138 were successful, representing a success rate of 14.18%. Furthermore, only 4,000 shares will be allotted per application instead of the amount that we applied for.

Due to high demand vs low supply, IPOs are generally hard-to-get.

How do we make money out of IPOs?

We mentioned the early-bird advantages for a successful IPO application, where the market price is likely to be higher than the IPO price, thus greatly reduced risk of loss. Furthermore, it's not difficult to sell your shares in an open market due to the huge number of participants in the market.

The easiest way to make money out of IPOs is to sell them on the first day of listing.

Do note that the market price of an IPO share is likely to be higher than the IPO issue price. Nothing is guaranteed though. Therefore we would advise everyone to do some research on that particular company before deciding to subscribe to their IPO. If you are feeling difficult to catch up on your own, you may also PM our Facebook page "The Investment Narrator" to get advices regarding any IPO for FREE.

Steps to apply for an IPO

We are going to use Solarvest Holdings Berhad as an example again. The IPO issue price of Solarvest is 35 sen.

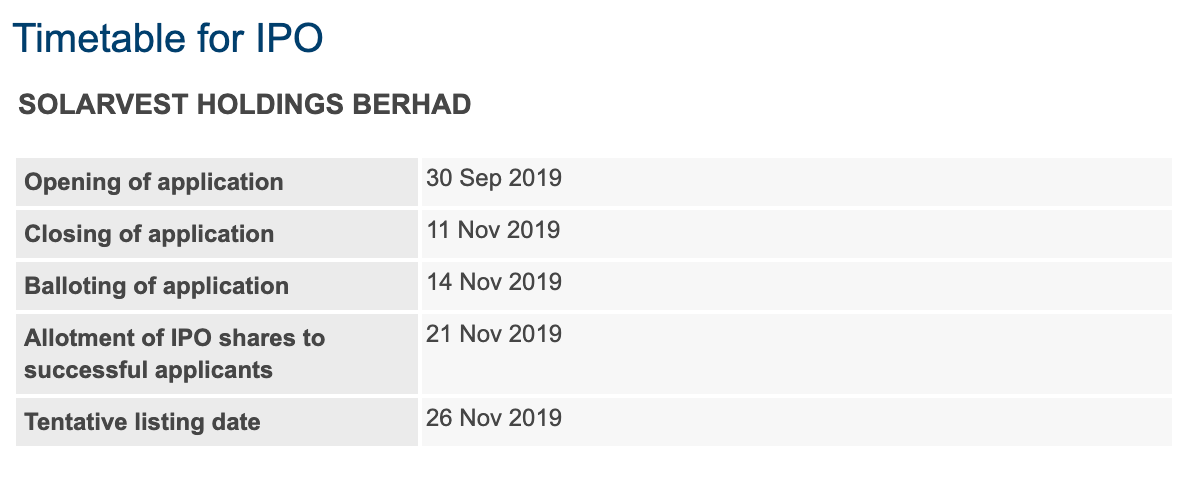

Step 1: Note down important dates of an IPO

The timetable of IPO can be obtained from official Malaysian Stock Exchange Website, i.e. BursaMalaysia.

Here is an excerpt from Solarvest:

The allotted shares will be debited into share account of successful applicants. Want to know what a share account is? We will cover it in the next article.

Also, there are two types of share account: Nominee and Direct . Direct account is eligible for IPO applications while Nominee is not. We will explain in further details in the next article as well.

Step 2: Apply for the IPO

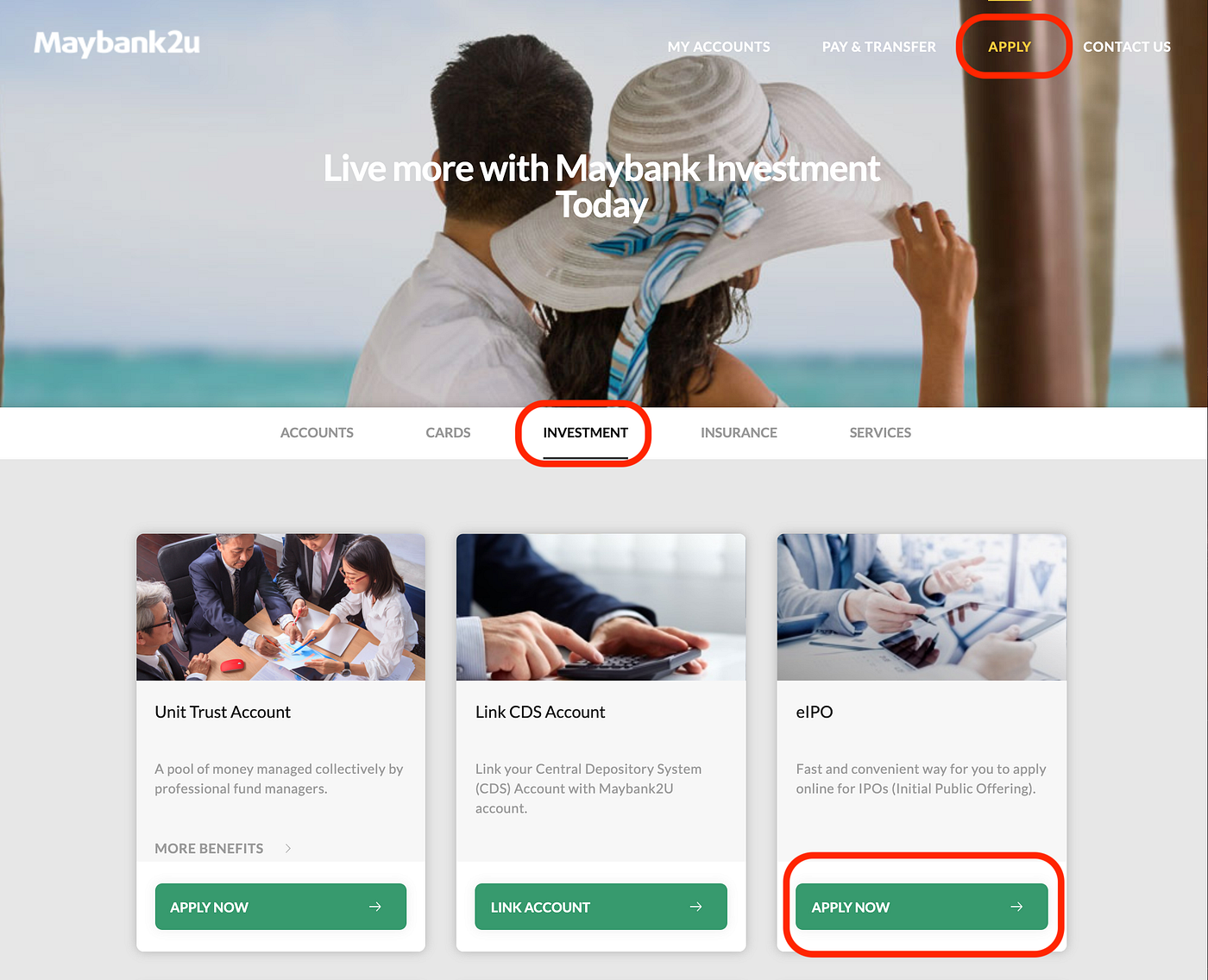

You can choose any online banking service of your preference. We are using Maybank2U in this example (only available in Web version)

Choose "Apply" from the top right, then "Investment". Under "eIPO", choose "Apply Now".

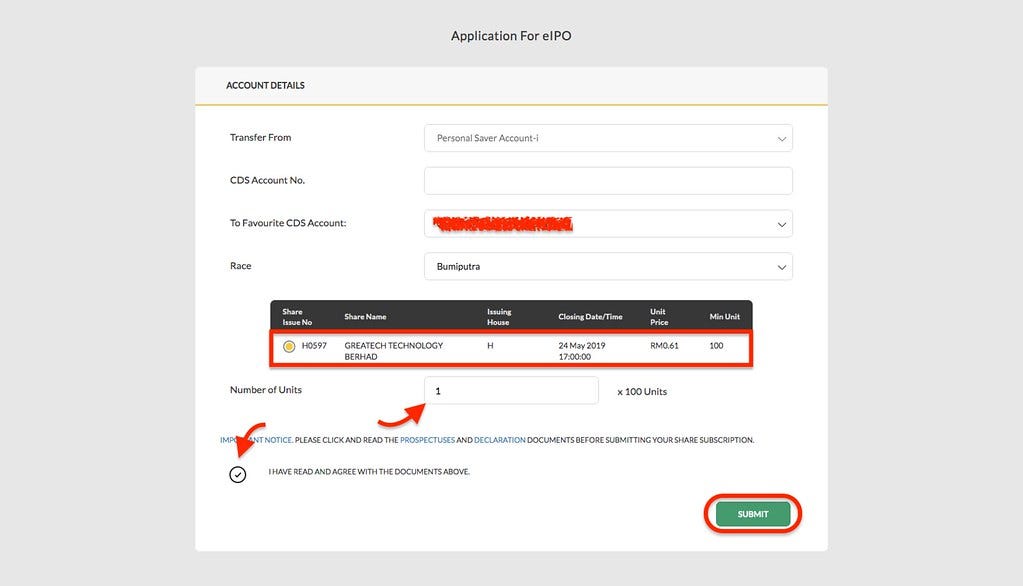

There were no IPOs available till the date of this writing, therefore we are using an older image as replacement. (Thanks Google!)

Enter CDS Account number, Race, Number of shares to apply, then proceed with your usual online banking transaction. Make sure your account balance is sufficient for the application!

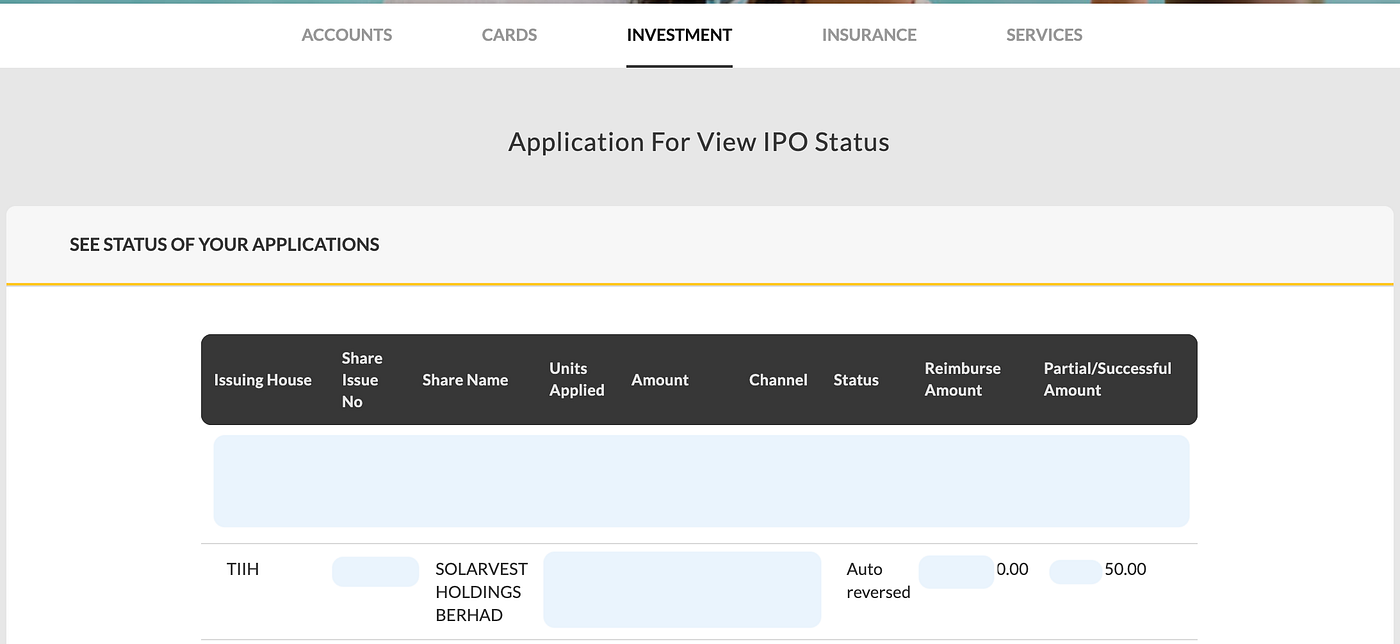

You can always come back later to check your application status. Choose "Apply" from the top right, "Investment", "View IPO Status".

You would see the result of your applications below.

Any unsuccessful applications will be fully refunded. Otherwise, the money you spent for the IPO application will be deducted by the "Partial/Successful Amount" before being refunded.

Final Words

By subscribing to an IPO, the public were given an opportunity to become a shareholder of the company at a relatively lower price and less demand to cash in hand. The early-bird traits of an IPO serves as a safety net for investors to minimise the risk of losing money in an IPO.

Nevertheless, not all IPOs are good investments. Snapchat, for instance, went for IPO at the issue price of $17, but its share price dropped since day 1 of listing, and never came back to $17, causing loss to the investors. We investors should be wary of them. Ask for professional advice (or ask us!) if you are unsure.

The information above is not, and should not be interpreted as any form of investment advices. You are solely responsible for your trading decisions and profit & loss. Thank you!

How Do Owners Make Money From An Ipo

Source: https://medium.com/@kydarun/how-to-make-money-from-an-ipo-64fe9a9d902d

Posted by: brownswougge.blogspot.com

0 Response to "How Do Owners Make Money From An Ipo"

Post a Comment